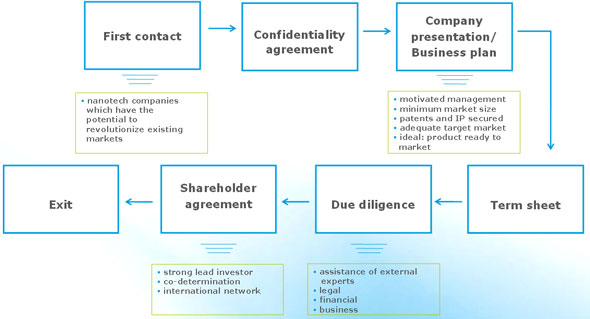

7) What are the key steps to closing a deal with a venture capital investor?

– Preliminary evaluation and review of business plan

– Preliminary negotiations

– Due diligence

– Deal closing

Typical process for a venture capital funding

Preliminary evaluation and review of business plan

The potential venture capital investor will begin by conducting an initial analysis and evaluation of the investment candidate. This usually starts with a review of the business plan because this document, if properly prepared, brings together all the key information which the potential investor needs to know.

Additionally, venture capital investors invariably place a high value on getting to know the management team personally in order to form an impression of their entrepreneurial and management capacity. This first formal meeting usually takes place in the form of a company presentation.

The potential venture capital investor will then generally use its own network of experts to find out more about the investment candidate. It will also, as part of the initial analysis, make a preliminary estimate of the company valuation. This is important because it will be used to determine what share of the company the investor will expect to receive in return for the investment capital. The valuation in this phase is generally in the form of a valuation range, with a minimum and maximum value. This range can then be used as a basis of negotiation between the venture capital investor and the candidate company.

Preliminary negotiations

If the initial meetings and evaluations go well, and both sides are interested in continuing negotiations, the basic terms and conditions of the proposed transaction will be summarized in a letter of intent or in a more detailed term sheet and signed by both sides.

A letter of intent is a document which simply declares that the parties have the intention of concluding an investment agreement, while a term sheet goes into considerably more detail and actually outlines the key terms and conditions for the subsequent investment agreement.

Whether the preliminary agreement is in the form of a letter of intent or a term sheet, it will outline the steps to reach the final investment agreement and the basis for valuing the company. It will include confidentiality and non-poaching clauses, and possibly also other legally binding clauses. You will also receive the relevant figures and calculations for the new investment.

Due diligence

Once the letter of intent or term sheet has been signed, the venture capital investor will then proceed with a "due diligence" examination of the company. Because this involves considerable time and expense, this is only conducted once the preliminary agreement has been signed.

Due diligence involves a rigorous, highly detailed, systematic analysis of a company, or of a part of a company or a business plan, with the objective of obtaining an overall impression of the company's current business and financial position, its future prospects, and the specific opportunities and risks which it faces.

Deal closing

Once the due diligence examination has been completed, the venture capital investor will examine the complete report. If its investment committee reaches a positive decision, the transaction will now proceed to final negotiations, culminating in the deal closing, where the formal investment agreements are signed by all parties.

At this point, the transaction moves into the investment phase, in which the venture capital investor actually provides the funds to the portfolio company. The venture capital investment ultimately ends with an exit by the venture capital provider.

Back

Back