| Posted: Jan 25, 2007 | |

Investing in nanotechnology stocks - golden opportunity or bad idea? |

|

| (Nanowerk News) There seem to be an increasing number of websites, articles and investment reports that push, some might say hype, nanotechnology investment as the next stock market super growth area. On the other hand, some investors are wary of a nanotechnology boom, where too much money chases too few listed companies, turning into a dot.com-like bust. | |

| Hype usually involves a bit of underlying truth about a trend but says nothing about whether something is going to be a good investment. As the International Herald Tribune put it: "While nanotechnology is spurring a revolution in electronics and medicine, investors seeking to benefit may need a lot of luck, as they did during the Internet bubble of the 1990s." | |

| The current interest in nanotechnology stocks is driven by the many advances that nanoscience and nanotechnology promise and the vast amount of products and applications where nanotechnology can be used in the future. | |

| The commercial realization of most of these promises lies in the (some say near, some say distant) future; things like quantum computing, molecular electronics, or lab-on-a chip medicine. In its current state, nanotechnology to a large degree takes place in labs and there is only a trickle of products coming to the market. All of these products are incremental improvements of existing products – scratch-resistant paint, better engine oil, antimicrobial household products, smaller chips, improved cosmetics, etc. | |

| What we are seeing right now is the beginning of a large technological trend and a stock buyer has to understand the difference between the many promises of nano- technologies, the research taking place today, and the actual contribution of nanotechnologies to commercial products. Let’s look at a few facts that might give some perspective on what investing in nanotechnology stocks today is about - how has the market performed so far? what exactly is a "nanotechnology stock"? and the issue with these trillion dollar market size forecasts. | |

Actual stock market performance |

|

| Firstly, let’s look at how nanotechnology investing has been faring so far. A good start would be a nanotechnology stock index. According to the mangers of these indexes, they provide a representative sample of promising nanotechnology stocks and their objective is to provide investors with the ability to track the nanotechnology sector. | |

| The performance of these indices shows a lot of volatility. The three major exchange-quoted indexes are the ISE-CCM Nanotechnology Index (launched in late 2005; symbol $TNY), the Lux Nanotechnology Index (launched in late 2005; symbol $LUXNI), and the Merrill Lynch Nanotech Index (launched in early 2005; symbol $NNZ). | |

|

|

|

|

|

| Source: Nanowerk analysis; data from Bloomberg; green line: Dow Jones Industrial Average | |

| Taking late 2005 as the starting point (that's when TNY and LUXNI were launched), until June all three indexes would have outperformed the Dow Jones Industrial Average. Then fortunes reversed and at the moment you would sit on losses of –5% to –10% while the Dow Jones has gained 15% over the same period. That spiking in early 2006 and then the sudden massive drop had no real reason – clear signs of a hyped and volatile stock market sector. | |

What exactly is a "nanotechnology stock"? |

|

| That depends on one’s definition. The definition of the ISE-CCM Nanotechnology Index is as follows: "Companies involved in the science and technology of building electronic circuits and devices from single atoms and molecules. Applications involve the intended ability to manipulate materials to fundamentally improve processes, materials, and devices on an ‘atomic’ scale." | |

| Merrill Lynch states in its documentation: "Our new criteria for inclusion in the index is companies that indicate in public documents that nanotechnology initiatives represent a significant component of their future business strategy. We believe this definition, although still subjective, is more objective than our previous criteria that companies must have a significant percentage of future profits tied to nanotech." | |

|

The problem with any definition of a “nanotechnology stock” or a “nanotechnology index” is that nanotech is not a clearly defined industry such as for instance the semiconductor or computer industry. Nanoscience affects many scientific fields, industries, markets and products. That is the reason why it makes more sense to speak of nanotechnologies rather than nanotechnology. A pure nanotech stock for instance would be a company that manufactures nanoparticles, and nothing else. But how about a chemical giant like BASF or DuPont? They produce nanomaterials. What portion of their revenues has to come from nanotech before they become a nanotech stock? Then there are companies that take pure nanomaterials and use them in their products to produce ‘nanointermediate’ products (coatings, fabrics, chips etc.). Again, how big a part of their production materials have to include nanomaterials in order for these companies to qualify as a nanotech stock? And finally, there are companies that take these nanointermediate products and use them to make end products such as cars, consumer electronics, mobile phones etc. – will these companies ever qualify as "nano- technology" companies? |

|

| Original graphic removed | |

| Lux Research has threatened legal actions against Nanowerk if we didn't remove the graphic that we previously showed here. They claim it violates their copyright, although the material we used didn't contain any copyright or usage restrictions and the material is freely available for download. Our graphic was a composite of the value chain that Lux Research uses and two examples for that value chain, one a "nano-enabled" Chevrolet Impala and the other "nano-enabled" mobile phones from Nokia and Samsung. | |

| In this current, early stage of (evolutionary) nanotechnology, most R&D investment aims to incrementally improve existing products by making them smaller, better, or cheaper. Any forecast and projection as to the possible commercial value of later stage (revolutionary) nanotechnology, resulting in radically new materials, products and applications, is entirely speculative at the moment. | |

Market size forecasts |

|

| The same problem with definitions arises when discussing the size of the nanotechnology industry. When you read about the market size forecast for nanotechnology the National Science Foundation’s “$1 trillion by 2015” inevitable gets quoted. Lux Research even estimates $2.9 trillion by 2014. These are huge numbers! By comparison, the entire U.S. consumer goods sector in 2005 was $877 billion. Even the entire industrial production of the United States in 2005 was a little less than $2.9 trillion. | |

| A casual reader will mistake this "nanotechnology market size" figure for the value of manufactured nanotechnology materials and products. However, these estimates refer to impacts – the impact nanotechnology will have across the entire value chain of a product that contains some form of nanotech. | |

| So, when people refer to the size of the nanotechnology industry by 2015 as a $1 trillion or $2.9 trillion market, they really include the value of the entire Chevy Impala – just because it contains a component that contains nanoparticles – as part of the nanotechnology market (see the figure above). It might be a fine car to some people but a nanotechnology product it is not. | |

|

|

|

| Original graphic removed | |

| Lux Research has threatened legal actions against Nanowerk if we didn't remove the graphic that we previously showed here. They claim it violates their copyright, although the material we used didn't contain any copyright or usage restrictions and the material is freely available for download. The graphic basically is a simple graph that plots the Lux Research forecast of sales of products incorporating nanotechnology from 2005 to 2014. It starts at around $300 million in 2005 to become $2.9 trillion by 2014. | |

| Breaking down the market size figure into nanomaterials, nanointermediates, and nanoenabled products shows that actual nanomaterials contribute less than 0.5%. Lux Research estimates the market for pure nanomaterials (carbon nanotubes, nanoparticles, quantum dots, dendrimers etc.) to grow to approx. $3.6 billion by 2010 (from $413 million in 2005). In comparison, the Lux forecast for the entire nanotechnology impact by 2010 is roughly $1,500 billion. | |

Golden opportunity or bad idea? |

|

| Whether investing in nanotechnology stocks today is an opportunity or not is to be answered by every investor for himself. It never hurts to be on the cautionary side though, and here are some concluding thoughts: | |

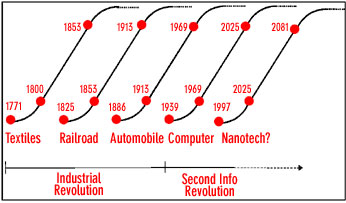

| Truly revolutionary nanotechnology products and materials available as commercial products are years in the future (some say only a few years; some say many years) and the companies dealing with these products and materials probably are not listed yet or don’t even exist yet. Economist Norm Poire at Merrill Lynch tracks a series of historical growth innovations. He argues that growth innovations drive the economy and the stock market. It takes about 28 years for a new technology to become widely accepted, which then fuels a period of rapid growth lasting about 56 years. Some 112 years after invention the innovation reaches maturity and grows in line with population increases. | |

|

|

|

|

|

| Source: Norman Poire, Merrill Lynch | |

| Whether nanotechnology becomes such a historical growth innovation remains to be seen. What is certain, though, is that the timeframe involved will span decades. | |

| The chosen definition of the ‘nanotechnology market’ defines the universe of companies to invest in. Yet even if one sticks to the most narrow definition, the pure nanomaterial manufacturers, the choice easily becomes confusing. A simplistic example: There is a small start-up that generates 100% of its revenues from producing carbon nanotubes. And there is a chemical giant that generates a tiny fraction of its revenues from producing carbon nanotubes. But the giant sells 10 times more nanotubes. Which company has a better chance for longer term success and which is the better investment? | |

| Looking at the components of the above-mentioned nanotech market indices, very few qualify as pure nanotech companies. Most are "nanointermediates" – companies that use some form of nanotechnology enabled product or process. In their ongoing quest to improve existing products by creating smaller components and better performance materials, all at a lower cost, the number of manufacturing companies that become nanointermediates will grow very fast and soon make up the majority of all companies across many industries. A "nanotechnology index" will then start to resemble an overall stock market index. Therefore evolutionary nanotechnology should not be viewed as an industry but rather a process that gradually will affect most companies in most industries. To what degree revolutionary nanotechnology will become an industry in itself remains to be seen. | |

| One of the biggest competitive strengths of nanotechnology companies is their intellectual property. Given the current issues with patent overlaps and patent thickets (see our Nanowerk Spotlight "The patent land grab in nanotechnology continues unabated, creating problems down the road") due diligence on the strength of a company’s IP position is a crucial component in assessing its prospects for longer term success. | |

| What are the environmental, health and safety risks of nanotechnology? This is totally unclear and research so far has been inconclusive. The emergence of a real hazard or problem could have a massive, irrational backlash against everything with the name “nano” in it (keep in mind what happened to genetically engineered food). | |

| Beware the hype. Investing in pure nanotechnology start-ups that have gone public could provide the same risk as investing in an early dot.com IPO. "By the time a company has gone public and that area has been established as hot, the valuations usually reflect the good news that could possibly happen." (IHT article quoted above). | |

| When confronted with large demographic, political, or technological trends, never just assume that the trend will provide a sufficient tailwind to power an individual stock. Instead, examine the company- specific factors. A tailwind is nice, but it's critical to understand the competitive advantages of companies in the space. Ask yourself why this company will be able to exploit the trend better than its competitors (quoted from Richard Gibbons at Motley Fool). | |

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com.