| Posted: Jan 10, 2011 | |

Nanotechnology business - The impact of nanotechnology on companies |

|

| (Nanowerk Spotlight) The fundamental characteristics of nanotechnology have led analysts to suggest that it may constitute a basis for long-term productivity and economic growth. It may also help to address pressing national and global challenges in areas such as health care, energy, water and climate change – you'll find plenty of examples here in our Nanowerk pages. | |

| While sites like Nanowerk and others focus more on traditional science and technology issues that highlight the broad-based nature of nanotechnology, others like consultants and analysts go wild in predicting huge markets (hey guys – are we still on for a $3 trillion dollar market anytime soon?) and contributions to entrepreneurship and job creation. | |

| Between those two areas, however, it is hard to obtain reliable information in terms of the implications for nanotechnology companies and nanotech business in general. But it is exactly this information that governments would need to determine how they should structure their innovation policies. | |

| The OECD, through its Working Party on Nanotechnology (WPN), has just published a report that nicely tries to fill this information gap. Titled "The Impacts of Nanotechnology on Companies" (you can buy it as an e-book from the OECD bookshop for €16 but if you google the title you'll also find some ebook mirror sites where you can download it for free), the 111-page book attempts to provide comprehensive, internationally comparable information on how different types of companies are affected by nanotechnology, how they use it in their innovative activities, how they acquire or develop relevant competences, as well as on the specific commercialization challenges they face. It also addresses the different role that new and small as well as larger companies will play in the commercialization of nanotechnology. | |

|

|

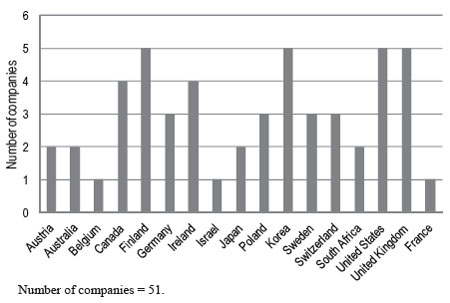

| Distribution of company case studies by country used for the OECD report. | |

| This OECD report is based on 51 company case studies, drawn from 17 countries, and covers a range of company sizes, nanotechnology sub-areas and fields of application. These case studies provide qualitative insights into the commercialization of nanotechnology from the viewpoint of companies and thus complement studies which have relied primarily on publication and patent data or statistical surveys. The question which the case studies have mainly addressed is whether new and specific challenges arise during the development and commercialization of nanotechnology which may require new types of policy responses. | |

| Main findings of the study | |

| – Nanotechnology is an enabling technology (or set of technologies) and the company case studies show that this feature is a major reason for their entry into the field. Nanotechnology allows for both the improvement of existing and the development of completely new products and processes, and sometimes new services as well. Companies often experiment with multiple applications at the same time, many of which are still in the research phase. | |

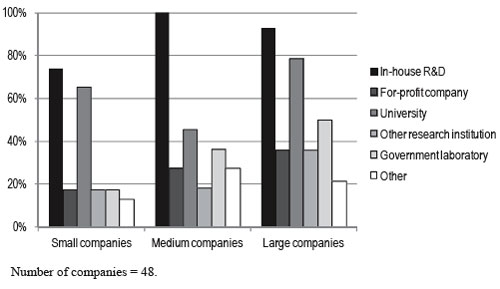

| – Nanotechnology may best be described as a "science-based and demand-driven field". While all of the case study companies undertake in-house R&D, collaboration with universities and "star scientists" are also important sources of innovation and knowledge, especially for small companies. Larger companies in relatively mature nanotechnology subareas appear to focus more on applications which are driven by market demand and tend to collaborate with a broader range of organizations to leverage their in-house R&D. | |

| – Nanotechnology mainly affects the R&D and production activities of the case study companies. Many of the smaller companies focus exclusively on nanotechnology, while the larger ones typically blend nanotechnology with a range of other technologies. In the larger companies it is thus difficult to single out the share of nanotechnology in total labour costs, R&D expenditure, production costs, capital spending and sales. | |

| – The larger companies in the sample have typically been involved in nanotechnology for many years and seem well placed to assimilate nanotechnology due to their established critical mass in R&D and production, their ability to acquire and operate expensive instrumentation and to access and use external knowledge. The relative strength of larger companies in the early phases of nanotechnology developments runs counter to what the traditional model of company dynamics and technology lifecycles would predict where smaller, younger companies are generally considered more innovative. | |

| –The case studies illustrate that nanotechnology is a complex field owing to its dependency on various scientific disciplines, research/engineering approaches and advanced instrumentation. Further, many nanotechnology sub-areas are in an early, immature, phase of development. These features of nanotechnology can often create barriers to entry especially for smaller companies which have limited human and other resources. They also contribute to the poor process scalability of nanoscale engineering during the transition from R&D to pilot and industrial scale production. | |

| – Difficulties arise for recruiting human resources, especially for R&D and production activities. The need for employees, or so-called gatekeepers, who combine specialist and general knowledge (knowledge integration) and can manage interdisciplinary teams is also a challenge. | |

|

|

| Sources of nanotechnology competences by company size. | |

| – Challenges to funding R&D and related activities are often mentioned, especially by business start-ups. The poor process scalability of R&D, which raises costs and prolongs new product development times, can make nanotechnology less attractive to investors. Uncertain regulatory environments and public perceptions of nanotechnology's environmental, health and safety (EHS) risks can also influence R&D funding. | |

| – The novelty of nanotechnology, the established interests of stakeholders, and difficulties that companies can have in communicating the value proposition of applications to potential customers (e.g. other companies), makes their entry and positioning in value chains harder. The challenge is even greater for smaller companies that experiment with multiple applications and have to monitor many different industries and business environments. | |

| – Intellectual property rights (IPR) may become an issue as commercialization progresses and nanotechnology matures as there is already a very wide range of patent claims, and the possible formation of patent thickets (interrelated and overlapping patents), which could contribute to barriers to entry for companies. | |

| – The potential for overreaction to both actual and perceived EHS uncertainties and risks, combined with regulatory uncertainties, complicates the business environment for companies. Global harmonization of future EHS regulations is considered important. | |

| The challenges of commercialization | |

| As the main objective of the project was to identify specific challenges for the commercialization of nanotechnology which may warrant new policy responses, the corporate responses to these issues were of particular interest. | |

|

|

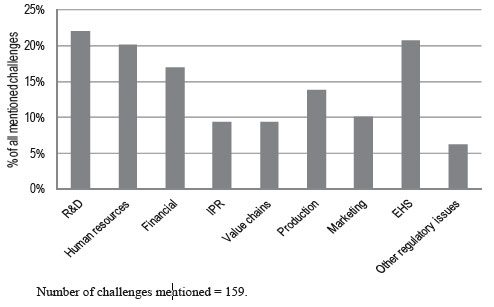

| Areas in which companies see a significant challenge for commercialization. | |

| The above figure displays the breakdown of the challenges identified by the companies. Challenges relating to R&D and EHS issues are, by a slight margin, most often reported, followed by human resource issues, financial resources and issues relating to production. A breakdown of these results by company size suggests that challenges relating in particular to human resources and EHS issues affect all case study companies. Challenges relating to production are mentioned somewhat more frequently by larger companies, and R&D and financial resources by smaller companies. Challenges relating to IPRs, value chains, marketing and other regulatory issues show less variability across company size. In terms of sub-areas, challenges relating to R&D rate high in nanobiotechnology and nanoelectronics. This may point to technical complexities and barriers in these areas. | |

| The point at which companies entered the field may also affect the findings. In this context, the only noteworthy variation is found for challenges relating to human resources, production and EHS issues. Companies that entered the field between five and ten years previously face greater challenges for human resources and production, while newcomers and more established companies do so for EHS issues. These differences may reflect companies' lifecycle rather than specific nanotechnology issues, given that expanding companies typically experience barriers to growth in terms of their ability to employ specialised personnel and expand production after the prototype phase. EHS issues seem especially challenging for larger companies which have progressed further in commercialization. | |

| The role of funding | |

| The case study companies draw on a range of sources of funding for their nanotechnology-related activities and no particular source appears to dominate. For obvious reasons larger companies stress somewhat more the importance of in-house sources. Amongst smaller companies, venture capital (VC) funding appears to be equally important to most other sources (traditional bank loans, business angels, private equity, initial private offerings, government, international programme such as the EU Framework Programmes, customers). Although firm conclusions cannot be drawn, it may be somewhat surprising that VC funding does not stand out as a particularly important source for smaller companies, given the role it has played for start-ups in ICT and biotechnology. | |

| The findings on VC funding are difficult to interpret, especially in light of the economic crisis. A nanotechnology-dedicated VC industry may not yet have emerged. Challenges in the scalability of manufacturing processes may also scare off VC investors that seek high and quick returns. From this viewpoint, nanotechnology differs from software technologies, for example. | |

| The frequent mention by smaller companies of challenges relating to financial resources often concerns the general problems of securing funding during the start-up phases of science-based entrepreneurship rather than nanotechnology specifically. However, in so far as start-up companies take the lead in commercializing nanotechnology, this may represent a significant barrier. | |

| Human resources | |

| Good news for all you nanotechnology students out there! The companies were asked to rank their anticipated human resource needs over the next five years by main areas of activity as well as the difficulties they experience in hiring employees for these activities. As expected, the highest anticipated need for human resources relates to R&D, followed by production, quality control, marketing and other activities that support commercialization more directly. Small companies anticipate more growth in demand for R&D- and production-related human resources than larger companies. In other respects, company size and nanotechnology subarea do not play a noteworthy role in the responses. | |

|

|

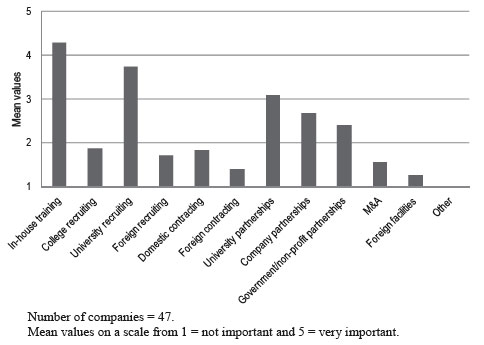

| Sources of needed nanotechnology skills. | |

| The anticipated higher need for, and difficulties in, recruiting human resources for activities relating to R&D and production, especially among small companies, reinforces the impression that R&D and production activities are related and that both are important for commercialization. Nanoscale manufacturing processes are R&D-intensive, complex and demanding, especially when moving from laboratory conditions towards prototype and industrial-scale production. Costs also play a role, as the acquisition of relevant instrumentation, machinery and equipment is expensive and their operation and maintenance may require dedicated human resources. | |

| The case studies give some indication that human resource challenges are making companies more dependent on recruiting personnel from abroad. Already, 50% of the case study companies now utilise foreign sources to hire new personnel, and 48% are considering doing so in the next five years. The dependence on foreign personnel is common among large multinational companies with global operations. However, for smaller companies domestic human resource constraints may create impediments to growth. The availability of foreign recruits naturally also depends on legal issues (for example immigration laws, work permit regulations, tax schemes), the competitiveness of universities, and the overall attractiveness of the country as a location for R&D activities. | |

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

|

|

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com. |

|