| Posted: Jan 11, 2012 | |

Polymer nanocomposites drive opportunities in the automotive sector |

|

| (Nanowerk Spotlight) Polymer nanocomposites represent a new class of multiphase materials containing dispersion of nano-sized filler materials such as nanoparticles, nanoclays, nanotubes, nanofibers etc. within the polymer matrices. Owing to their nanoscale size features and very high surface-to-volume ratios, they possess unique combination of multifunctional properties not shared by their more conventional composite counterparts reinforced with micro-sized fillers. | |

| These multifunctional nanocomposites not only exhibit excellent mechanical properties, but also display outstanding combination of optical, electrical, thermal, magnetic and other physico-chemical properties. It is believed that the molecular level interactions between the nanoparticles and polymer matrices along with the presence of very high nanoparticle-polymer interfacial area play a major role in influencing the physical and mechanical properties of nanocomposites. The major development in this field has occurred over the last two decades. | |

| This article summarizes the progress, products outlook, advantages, and limitations of nanocomposites in the automotive industry. | |

| Nanocomposites are an emerging class of polymeric materials exhibiting excellent mechanical properties, enhanced modulus and dimensional stability, flame retardancy, improved scratch and mar resistance, superior thermal and processing properties, reduced warpage of components and enhanced impact resistance making them suitable to replace metals in automotive and other applications1. | |

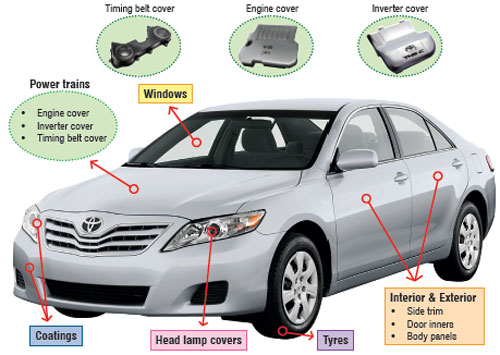

| The key drivers for the use of polymer nanocomposite-enabled parts in the automotive industry are reduction in vehicle's weight, improved engine efficiency (fuel saving), reduction in CO2 emissions and superior performance (greater safety, increased comfort and better driveability). Fig. 1 illustrates the usage of polymer nanocomposites parts. | |

|

|

| Fig 1: Illustration of the usage of polymer nanocomposites parts. | |

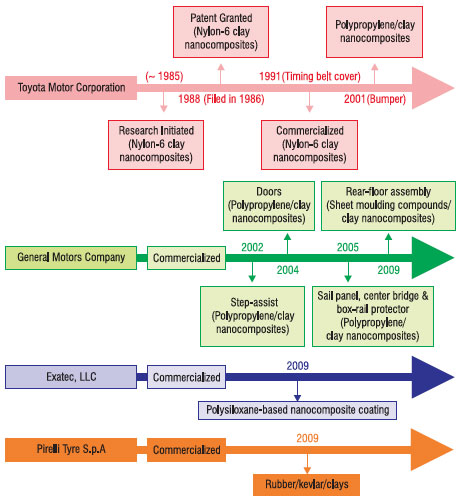

| The commercialization of polymer nanocomposites started in 1991 when Toyota Motor Co. first introduced nylon-6/clay nanocomposites in the market to produce timing belt covers as a part of the engine for their Toyota Camry cars, in collaboration with Ube industries in 19912. At about the same period, Unitika Co. of Japan introduced nylon-6 nanocomposite for engine covers on Mitsubishi GDI engines3 manufactured by injection moulding, the product is said to offer a 20% weight reduction and excellent surface finish. In 2002, General Motors launched a step-assist automotive component made of polyolefin reinforced with 3% nanoclays, in collaboration with Basell (now LyondellBasell Industries) for GM's Safari and Chevrolet Astro vans, followed by the application of these nanocomposites in the doors of Chevrolet Impalas4,5. | |

| The real surge in the commercialization of nanocomposites production has occurred over the last ten years. In 2009, a one-piece compression moulded rear floor assembly was made by General Motor (GM) for their Pontiac Solace using nano-enhanced Sheet Moulding Compounds (SMCs) developed by Molded Fiber Glass Companies (MFG), Ohio. This technology is also in use on GM's Chevrolet Corvette Coupe and Corvette ZO6. The nano-filled SMCs exhibit significantly lower density than conventional SMCs resulting in improved fuel efficiency6. The automotive industry can benefit from polymer nanocomposites in several applications such as engines and powertrain, suspension and breaking systems, exhaust systems and catalytic converters, frames and body parts, paints and coatings, lubrication, tires, and electric and electronic equipment. | |

| In the latter part of the 1980s and the beginning of the 1990s, a research team from Toyota Central Research Development Laboratories (TCRDL) in Japan reported work on a Nylon-6/clay nanocomposite and disclosed improved methods for producing nylon-6/ clay nanocomposites using in situ polymerization similar to the Unichika process7-10. | |

| The research findings demonstrated a significant improvement in a wide range of physico-mechanical properties by reinforcing polymers with clay on the nanometer scale 11,12. The Toyota research team also reported various other types of clay nanocomposites based on polymers such as polystyrene, acrylic, polyimides, epoxy resin, and elastomers using a similar approach13-17. Since then, extensive research in nanocomposites field has been carried out worldwide. Fig. 2 shows timeline for the commercialization of products by automotive players. | |

|

|

| Fig. 2: Timeline for the commercialization of products by automotive players. | |

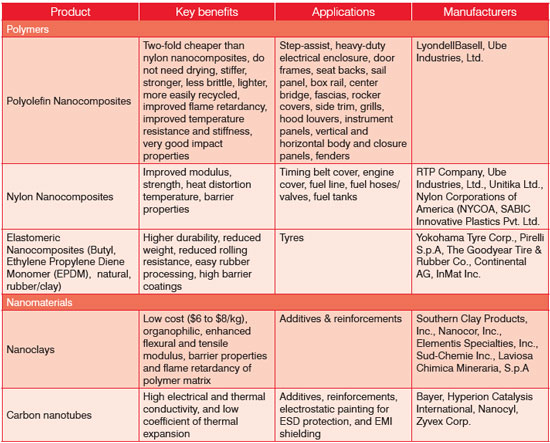

| Among nanomaterials, nanoclays are the most commonly used commercial additive for the preparation of nanocomposites, accounting for nearly 80% of the volume used. Carbon nanofibers, carbon nanotubes (mainly MWCNTs), and Polyhedral Oligomeric Silsesquioxanes (POSS) are also being used commercially in nanocomposites, gaining ground fast with improvements in cost/performance and processability characteristics. | |

| The largest demand for nanoclays in nanocomposites is primarily driven by the need to meet the customers' (OEMs/tier I/II/III) cost expectations and performance of end-use parts, as nanoclays are less expensive ($6 to $8/kg) than other nanomaterials and exhibit improved balance of stiffness and toughness, excellent mechanical and barrier properties, enhanced heat deflection temperature without loss in elongation, improved colorability and improved scratch and mar resistance. | |

| Nanoclays also offer a reduction in relative heat release, excellent dispersion and exfoliation, excellent flame retardant synergy, and reduced weight. Polyolefin is commonly used as host polymer and thermoplastics such as polyamide (nylon), Polyphenylene Sulfide (PPS), Polyetheretherketone (PEEK), Polyethylene terephthalate (PET), polycarbonate, thermosets such as epoxy, and thermoplastic elastomers such as butadiene-styrene diblock copolymer are also used in more demanding automotive applications. The use of thermoplastics as a matrix material in nanocomposites has been growing steadily, especially in automotive applications, largely due to the material's low cost, high performance, low density, longer shelf life, easy dispersion and processing with nanomaterials, ability to regrind, and recyclability. Thermoplastics also offer enhanced mechanical, thermal, electrical and barrier properties, excellent fracture toughness over thermosets as well as the ability to be easily joined by mechanical joining and welding techniques. | |

| Organoclays are most widely used as a nanofiller, while carbon nanotubes are also gaining acceptance. The two major producers are Southern Clay Products, Inc. with its Cloisite products line and Nanocor Inc. with its Nanomer products. Carbon nanotubes impart electrical and thermal conductivity, which allows electrostatic painting and when blended with nylon, to protect against static electricity in the fuel system. However, their commercial development is hindered by their high price tags ($20/gram), although they are available in master batches (containing 15% to 20% nanotubes) for about $50-60/lbs. Table 1 shows some examples of commercially available nanocomposites and nanomaterials. | |

|

|

| Table 1: Raw Materials/ Nanointermediates Manufacturers. | |

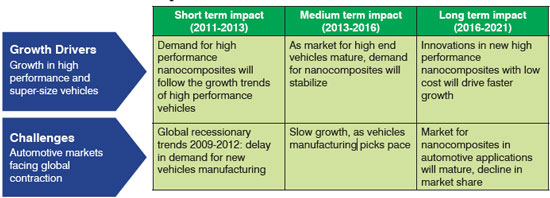

| Polymer nanocomposites are an emerging technology in the automotive industry and have attracted considerable attention worldwide. The commercial success of nano-enabled products for the automotive market has been slow and used currently only in niche applications such as external body parts, interior and under-bonnet parts, coating and fuel system components, etc., but is expected to be a major growth area in the coming era. | |

| The usage of polymer nanocomposites continues to grow in the automotive sector, thanks to their exclusive mechanical, chemical, thermal, electrical and barrier properties and contribution to fire retardancy. A market research report, "Nanocomposites-A Global Strategic Business Report", (Electronics.ca Publications) states that world nanocomposites market is forecast to reach 1.3 billion pounds (lbs) by the year 2015, and growth in the nanocomposites market will be driven by robust demand outlook in the emerging application possibilities in automotive market18. By 2011, the automotive sector is expected to become the third-largest market for polymer nanocomposite applications, with over 15% of the market19. According to a recent market report released by Frost & Sullivan, it is expected that carbon nanotubes will penetrate about 3.6% within automotive composites. If 1% CNT's are loaded in these materials, it is estimated that CNT market for auto composites would be $35.52 million20. It is interesting to note that the projected market share in 2015 of automobile tires is 23% of the total nanotech market in the automobile sector, and it is fully dedicated to the field of nanocomposites. | |

| Elastomeric nanocomposites are also gaining momentum in automotive industry especially for tires application due to their lower rolling resistance, lower weight and superior performance in terms of fuel saving. The key drivers for these materials are growing demand for fuel efficiency, strict automotive standards for safety, enhanced durability and noise reduction. For example, elastomer replacement of traditional inner-liners with nanocomposite inner-liners reduces permeability by 50 % and thus results in a decrease of approximately 4 lbs per truck and also improvement in fuel efficiency (2%). Major automotive tire producers involved in the development and manufacturing activities pertaining to nanocomposites are Yokohama Tyre Corp., Japan, Pirelli S.p.A, Italy, The Goodyear Tyre & Rubber Co., USA, Continental AG, Germany, InMat Inc., USA etc. Elastomeric nanocomposites-enabled tire models include Goodyear UltraGrip Ice+, Continental EcoContact5, Michelin Energy Saver, and Pirelli Cinturato P1. | |

| Lanxess AG, Germany, Evonik Degussa GmbH, Germany, Cobot Corp., USA, Nanocor, USA, FCC Inc., China, Elementis Specialities plc, UK, Tokuyam, Japan and Rhodia, France are some of the leading producers of nanofillers. | |

| Green nanocomposites or biodegradable nanocomposites (cellulosic bio-plastic reinforced with clay) are the next generation of materials for automotive applications. They have the potential to replace or substitute existing petroleum derived non biodegradable Thermoplastic PolyOlefin (TPO)-enabled nanocomposites. | |

| Key Benefits and Challenges | |

| The advantage of nanocomposites over conventional composites is that their mechanical, electrical, thermal, barrier and chemical properties such as increased tensile strength, improved heat deflection temperature, flame retardancy, etc. can be achieved with typically 3-5 wt.% loading of the nanomaterials such as clays, nanotubes and nanofibers while the latter require a high content of the inorganic fillers from 10 wt. % to as much as 50 wt.% in general, to impart the desired properties. | |

| Another advantage of nanocomposites is that the strength, shrinkage, warpage, viscosity and optical properties of the polymer matrix are not significantly affected. The enhanced properties are attributed to the structure and morphology of the nanocomposite, as they (clays/polymer) contain organically treated clays such as hectorite, montmorillonite, and synthetic mica as well as nanotubes (carbon nanotubes, halloysite nanotubes). These nanomaterials have a large aspect ratio (1000:1) and each one is approximately 1 nm thick and hundreds or thousands of these layers are stacked together with weak Van der Waals forces to form a clay particle, resulting in subsequent exfoliation in which the individual layers are peeled apart and then dispersed throughout the polymer matrix. The excellent degree of exfoliation, which results in smaller particle sizes and provides the greater surface area to interact with the host polymer, results in improved performance. CNTs-enabled nanocomposites are also receiving attention as a mechanical reinforcement and electrically conductive additive for automotive fuel system line components requiring electrical conductivity. | |

| However, there are still many limitations and challenges for nanocomposites production. These include: | |

|

|

|

| Polymer nanocomposites can be manufactured through a wide variety of different routes. In essence, there are three generic routes to make nanocomposites: in situ polymerization, solution induced intercalation, and melt processing. Polymer nanocomposites based on melt blending of an organoclay and a thermoplastic matrix have end-use properties directly controlled or influenced by the state of dispersion and exfoliation of the clays (chemically modified with surface treatments), and thus the resulting nanostructure. Therefore, it is of immense importance to achieve perfect intercalation and exfoliation of these systems. Table 2 deals with growth drivers and challenges related to market dynamics. | |

|

|

| Table 2: Growth Drivers & Challenges | |

| Products Outlook | |

| There have been significant research and development activities in nanocomposites for the automotive industry, with nanocomposites finding commercial applications since 1991 in bumpers, step-assists, gas tanks, fuel pumps, interior and under-bonnet parts, body panels, electrical parts and appliances, power tool housings, packaging and building components, shock absorbers, coatings, lubricants and coolants. In addition, nanocomposites offer a variety of functions in automotive end-use parts such as structural plastic parts that exhibit higher mechanical performance with reduced weight, tires reinforced with nanoparticles for better abrasion resistance and improved gas permeability, fuel-borne catalysts for soot prevention in particulate filters, car body coatings for greater scratch resistance and improved gloss, and anti-fog coatings for headlights and windshields. | |

| The performance-to-cost ratio has been a major hurdle for gaining broader market acceptance as nanocomposites should meet the OEMs'/molders'/customers' cost expectations. Some early commercialized products have lapsed for cost reasons; damages include an automotive timing-belt cover based on nylon-6/clay nanocomposites from Japan's Unitika and an automotive mirror housing of conductive Polyphenylene Oxide (PPO)/nylon blends nanocomposites from GE Plastics. However, tremendous effort has been put forth by OEMs and molders to commercialize more volume of nanocomposites in automotive components. | |

| Today, demand for thermoplastic polyolefin/polypropylene nanocomposites has moved beyond nylon 6/clay nanocomposites, mainly because of their low cost and enhanced physico-mechanical properties. In the past, the automotive industry was more inclined towards using nylon 6/clay nanocomposites for under-the-hood applications, where higher heat deflection temperature, enhanced stiffness, and light weight were the goals. The performance-to-cost ratio was a main constraint which halted the rapid growth of polymer nanocomposites. However, nylon 6/clay nanocomposites (more costly) are still used for under the hood applications, fuel lines and fuel system components. | |

| Future Development and Directions | |

| It is quite evident from the foregoing discussion that polymer nanocomposites are finding many applications in the automotive industry, and the market for these materials is on the path of growth and expansion. The OEMs/Tier I, Tier II, Tier III, raw materials/nanointermediates manufacturers, researchers and technologists are realizing that other than clays, nanomaterials like graphene, carbon nanofibers, nanofoams, multiscale hybrid reinforcement and graphene-enabled rubber nanocomposites could drive the market dynamics. | |

| The price and performance advantages of graphene are challenging carbon nanotubes in polymer nanocomposites applications due to its intrinsic properties and it is predicted that a single, defect-free graphene platelet could have an intrinsic tensile strength higher than that of any other material21. | |

| In June 2010, a U.S. Patent was granted to The Trustees of Princeton University for functional graphene-rubber nanocomposites22, which can be produced at a much lower cost than carbon nanotubes and exhibits excellent mechanical strength, superior toughness, higher thermal stability and electrical conductivity. This graphene-rubber nanocomposite can be employed in all the areas for gas barrier applications including tires and packaging. | |

| A similar patent was granted in 2011, for a composite material of nanoscale graphene and an elastomer for vehicle tire application23. The multiscale hybrid reinforcement is another potential polymer nanocomposite material for the automotive industry due to its enhanced load transfer at the reinforcement/matrix interface, i.e. by tailoring the interfacial shear strength, which is made of micro sized carbon-fibre yarns and fabrics coated with carbon nanostructures. The high performance racing cars and high-end sports cars require excellent properties such as structural stiffness, heat shielding, impact and compressive strength, and many others. The polymer nanocomposite foams could be the right choice of material as they exhibit improved thermal insulation properties, superior peak load-bearing capacity, higher threshold loads and impact loads. | |

| The various stakeholders in the automotive value chain need to take note of polymer nanocomposites technology and development, which has a growing market globally, but the higher cost of the end-use components is a shortcoming which needs to be overcome. | |

| Conclusion | |

| The past few years have seen remarkable technological advances in polymer nanocomposites for the automotive market, particularly with respect to the thermoplastic polyolefin and polyamide nanocomposites synthesis and their commercialization as well. These breakthroughs have not only solved some fundamental problems (exfoliation & dispersion) in making the polymer nanocomposites, but have also changed their cost/performance structure and market demand. Thus, for external body parts, interior and under-bonnet parts, coating, fuel lines and fuel system components applications, nanocomposites have gained tremendous acceptance by the OEMs and molders in the automotive market. The first industrial production of nanocomposites in the automotive industry occurred in 1991 with the production of timing belt covers as part of the engine for Toyota Camry cars. | |

| The growth in activity surrounding nanocomposites continues unabated as more R&D funds are poured in by the funding agencies, venture capitalists and companies as they look to exploit the expanding range of novel properties that are being discovered. To give an example, in Europe, the automotive industry invests over 5% of its annual turnover in R&D and the major focus is on developing better coatings and paints, and stronger, more durable end-use parts. The use of polymer nanocomposites in the automotive market is thus set to escalate over the next ten years. | |

| References | |

| 1. S. Komarnenei, "Nanocomposites" J. Mater. Chem., 2 (1992) 1219-1230 | |

| 2. www.moldedfiberglass.com/library/news/newsCW8-09.pdf | |

| 3. L.W Carter, J. G Hendricks, D. S Bolley, "Elastomer Reinforced with a Modified Clay" US Patent No. 2,531,396, November 28, 1950 (Filed on March 29, 1947), Assignee: National Lead Co. | |

| 4. P. G. Nahin and P. S. Backlund, "Organoclay-Polyolefin Compositions", US Patent No. 3,084,117, April 2, 1963 ( Filed on April 4, 1961), Assignee: Union Oil Co. | |

| 5. S. Fujiwara, T. Sakamoto, "Method for Manufacturing a Clay/Polyamide Composite", Japanese Kokai Patent Application No.109,998 (1976), Assignee: Unichika K.K., Japan | |

| 6. Y. Fukushima and S. Inagaki, "Synthesis of an Intercalated Compound of Montmorillonite and 6-Polyamide", Journal of Inclusion Phenomena, 5 (1987) 473-482 | |

| 7. Y. Kojima et al., "Sorption of Water in Nylon 6-clay Hybrid", Journal of Applied Polymer Science, 4 (1993) 1259-1264 | |

| 8. A. Usuki, Y. Kojima, M. Kawasumi, A. Okada, Y. Fukushima, T. Kurauch and O. Kamigaito, "Synthesis of Nylon 6/Clay Hybrid", Journal of Materials Research, 8 (1993) 1179-1184 | |

| 9. A. Usuki, T. Mizutani, Y. Fukushima, M. Fujimoto, K. Fukumori, Y. Kojima , N.Sato, T. Kurauch and O. Kamigaito, "Composite Material containing a Layered Silicate", US Patent no 4,889,885, December 26, 1989 (Filed on March 4, 1988), Assignee: Kabushiki Kaisha Toyota Chuo Kenkyusho, Japan | |

| 10. A. Okada, K. Fukumori, A. Usuki, Y. Kojima, N. Sato, T. Kurauchi and O. Kamigaito,"Rubber-Clay Hybrid-Synthesis and Properties", ACS Polym Preprints, 32 (1991) 540-541 | |

| 11. A. Okada, A. Usuki, "The Chemistry of Ppolymer-Clay Hybrids", Materials Science and Engineering, C 3 (1995) 109-115 | |

| 12. K. Yano K. Usuki A. Okada and A. T. Kurauch, "Polyimide Composite Material and Process for Producing the Same" US Patent No. 5,164,46, Nov.17, 1992 (Filed on May 30, 1991), Assignee: Kabushiki Kaisha Toyota Chuo Kenkyusho, Japan | |

| 13. K. Yano , A. Usuki and A. Okada, " Synthesis and Properties of Polyimide-Clay Hybrid Films", Journal of Applied Polymer Science: Part A, Polym Chem., 35 (1997) 2289-2294 | |

| 14. F. Gao, "Clay/Polymer Composites:The Story", Materials Today, 7(2004) 50-55 | |

| 15. C. Edser, "Auto Applications of Drive Commercialization of Nanocomposites", Plastic Additives Compounding 4 (2002) 30-33 | |

| 16. T. Kurauchi, A. Okada, T. Nomura, T. Nishio, S. Saegusa and R. Deguchi, "Nylon 6-Clay Hybrid - Synthesis, Properties and Application to Automotive Timing Belt Cover", SAE Technical Paper Ser, 910584 (1991) | |

| 17. H.Cox, et al., "Nanocomposite Systems for Automotive Applications", Presented at 4th World Congress in Nanocomposites, EMC, San Francisco, 1-3 September 2004 | |

| 18. "Nanocomposites-A Global Strategic Business Report", March 2011, published by Electronics.ca, http://www.electronics.ca/presscenter/articles/1404/1/Global- Nanocomposites-Market-to-Reach-13-Billion-Pounds--by-2015/Page1.html | |

| 19. "Nanocomposites, Nanoparticles, Nanoclays, and Nanotubes", June 2006, published by BCC Research, http://www.bccresearch.com/report/NAN021C.html | |

| 20. "Potential Market for Carbon Nanomaterials' Applications", February 28, 2011, published by Frost & Sullivan, , www.nist.gov/cnst/upload/Valenti-NIST.pdf | |

| 21. Q.Z. Zhao, M.B. Nardelli, J. Bernholc, "Ultimate Strength of Carbon nanotubes: A Theoretical Study", Phys. Rev. B ., 65 (2002) 144105 | |

| 22. R. Prud'homme, B. Ozbas, I. Aksay, R. Register, and D. Adamson, "Functional Graphene-Rubber Nanocomposites", U.S. Patent 7,745,528, June 29, 2010 (Filed on October 06, 2006), Assignee : The Trustees of Princeton University | |

| 23. Aruna Zhamu, Bor Z. Jang "Pristine Nano Graphene-Modified Tires", US Patent 7,999,027, August 16, 2011 (Filed on August 20, 2009), Assignee: Nanotek Instruments, Inc. | |

| Contributed by Vivek Patel and Dr. Yashwant Mahajan, CKMNT. For more information, interested readers may please contact either Vivek Patel at [email protected] or Yashwant Mahajan at [email protected] and obtain a copy of the full-text article in pdf format. | |

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com. |

|