| Posted: Oct 21, 2009 | |

Funding a nanotechnology venture |

|

| (Nanowerk Spotlight) Nanotechnologies are opening vast new opportunities for scientists, engineers and entrepreneurs to participate in solving some of the major problems facing mankind today. Nanotechnology-based innovations which are successfully commercialized into viable products or processes can revolutionize entire industries and significantly improve the quality of life for millions of people. | |

| But the road from idea to commercially viable product or process is long. Especially when it comes to nanotech innovations, the research and development phase tends to be relatively lengthy. Moreover, the exact duration of this phase is difficult to predict, and it not may not even be clear if the idea will ever be successful. This long R&D phase involves not only a substantial investment of time and effort but also requires a relatively large amount of capital investment because during this period, there is no revenue to offset the expenses. | |

| Although large corporations in industries from chemicals to computer technology are themselves investing heavily in nanotechnology applications, this field nonetheless offers a wide range of opportunities for entrepreneurs to establish successful new businesses. In Germany alone there were some 750 such companies at the end of 2008 engaged in the development and sales of nanotechnology-based products and processes along various parts of the value creation chain. More than 63,000 people work in these companies. | |

| This time from initial idea to successful market introduction is often called the "valley of death". It is in this phase that most new ventures fail. The reason for these many failures is generally that one of four specific start-up risks could not be overcome. It is therefore essential for any start-up – regardless of the industry – that the management team has carefully considered these four aspects of risk and correctly understands how these may determine the success or failure of the business venture. | |

| The technology: “Can we build it?” Will we be able to make the proposed product or device? How difficult will it be to manufacture it? Can the key manufacturing processes and product designs be protected through patents? | |

| The team: “Can we execute the idea?” Has our company staffed the key positions with the right people? Do these people have the needed skills and experience? Can our team implement the business concept? | |

| The market: “Will they buy it?” What does the market for our planned product look like? Who will the potential customers be? Who are our competitors? Can the product be sold at a price which will yield us a profit? How should the product be introduced into the market? | |

| The money: “How do we pay for it all?” Do we have sufficient access to capital and liquidity? If not, how will we get additional financing? How sound and realistic is the financial plan, not only in terms of future revenues but also projected expenses? | |

| It is this last aspect – the financing of start-ups – which is often the greatest stumbling block for aspiring entrepreneurs, particularly for those who come from scientific or technical backgrounds and have as of yet little experience with practical business issues. | |

|

|

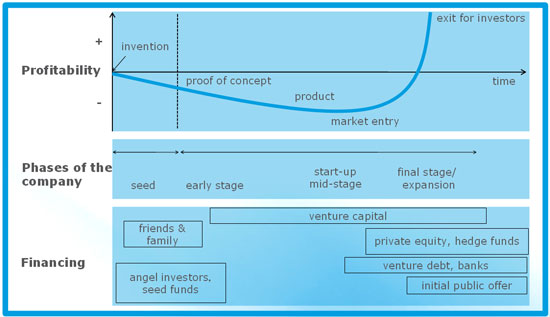

| Phases of company growth and financing. (Source: Nanostart AG) | |

| To translate their nanotechnology innovations into commercially successful products and processes, and to reap their full business potential, it is therefore essential that founders of nanotech start-ups arrange reliable financing at an early stage. | |

| To help potential nanotechnology start-up founders with shaping their plans, Nanowerk, the leading nanotechnology information service, and Nanostart, the world’s leading nanotechnology venture capital company, have teamed up to provide this useful guide which particularly addresses the funding aspects of nanotechnology start-ups, along with answers to some of the most commonly asked questions. | |

|

|

| This overview is intended for potential nanotechnology entrepreneurs who would like to get a better understanding of what venture capital financing could do for them and what requirements they would need to meet in order to successfully approach a venture capital investor such as Nanostart. | |

| Throughout this new section on “Successful founding and financing of nanotechnology companies” you will find answers to some of the most commonly asked questions and practical information about some of the fundamental issues that every nanotechnology entrepreneur will encounter when approaching a prospective investors. We will address the following critical questions which any potential entrepreneur should be asking himself or herself: | |

|

|

|

| Read through this and think about it. If you come to the conclusion that proceeding with a start-up is not for you, at least you now understand what such an undertaking involves and what others go through in getting their business idea off the ground. If, on the other hand, you are now more determined than ever to push ahead with your idea, we hope that this guide was useful in shaping your concept and moving forward with a viable business plan. | |

| Read the 8-part "Successful founding and financing of nanotechnology companies" here. | |

| Good luck! | |

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com. |

|