| Posted: Jul 26, 2007 | |

The struggle of nanotechnology companies to create value |

|

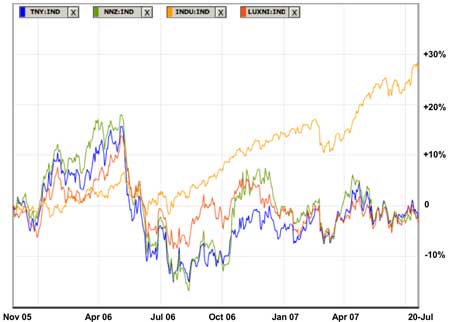

| (Nanowerk Spotlight) If you have been an investor in nanotechnology companies and been lured by the promised riches, the picture doesn't look very pretty right now. We have updated our Nanotechnology Stock Index Performance chart, that we first showed six months ago ("Investing in nanotechnology stocks - golden opportunity or bad idea?"), and the performance gap between the Dow Jones and the nanotechnology index funds has widened significantly (it looks even worse if you replace the Dow Jones industrial Index with a broad market index such as the Russell 2000). Of course, individual nanotechnology stocks have done better, but then, some have done much worse. That brings us to the question: What will it take for nanotechnology, taken as a set of enabling technologies, to realize its disruptive potential and create value for nanotechnology companies? An interesting answer can be found in an analysis of the recent Unidym and Carbon Nanotechnologies merger. Growth in the sector through consolidation may enable the creation of companies with the critical mass necessary to finally get public investors really excited about nanotechnology. | |

| Just a brief recap on the performance of the nanotechnology indices. The three major exchange-quoted indexes are the ISE-CCM Nanotechnology Index (launched in late 2005; symbol $TNY), the Lux Nanotechnology Index (launched in late 2005; symbol $LUXNI), and the Merrill Lynch Nanotech Index (launched in early 2005; symbol $NNZ). We took November 2005 as the starting point (that's when TNY and LUXNI were launched) and mapped against the Dow Jones Industrial Index. | |

|

|

| Nanotechnology stock indices. performance. Source: Nanowerk analysis; data from Bloomberg; yellow line: Dow Jones Industrial Average | |

| On April 23, 2007, Carbon Nanotechnologies, Inc. (CNI), a Texas-based manufacturer of carbon nanotubes and Unidym, a developer of nanotube-based electronics in Silicon Valley, announced the merger of the two companies. The combined company, called Unidym, will be operated as a majority-owned subsidiary of Arrowhead Research. | |

| "This transaction should be viewed as an important sign of the growing maturity of the nanotechnology business community" Ruben Serrato tells Nanowerk. "The pooling of investment capital, alignment of strategy and integration of materials and device production reflect a move away from early technology arrogance towards the beginning of a more sober market approach necessary for the commercialization of nanomaterials." | |

| Serrato is Venture Partner with Tokyo Electron Venture Capital, where he leads investments in semiconductor, alternative energy, nanomaterials and advanced electronic device companies. Together with Kevin Chen, Technical Marketing Director at NanoGram Corporation, he analyzed the Unidym/CNI merger in a recent paper in Nanotechnology Law & Business ("Mergers and Acquisitions of Nanotechnology Companies: A Review of the Unidym and CNI Merger"). | |

| Serrato and Chen draw four central conclusions from their analysis of the merger: | |

| The need for nanotech companies to focus on real products and revenues | |

| Here is a key statement that holds true for all nanotech companies: "The basic task of achieving profitability still lies ahead." | |

| "Instead of conjuring up new dreams of nanotech grandeur, the merger should be a wake up call for many nanotechnology companies" says Serrato. "The early hopes of some companies for unfettered success have proved to be elusive. High profile companies like CNI, Nanosys, and others have stumbled as a result of business strategies that placed too much emphasis on IP and produced too few results in terms of revenues." | |

| Integration of nanomaterials suppliers with companies focused on developing products incorporating nanomaterials is necessary to achieving commercial success | |

| The implicit valuation of CNI in the merger is a brutal wake-up call to nanomaterials producers, investors and intellectual property (IP) owners. | |

| On its website, CNI says that it works with "close to 700 customers worldwide" and that it has an "extraordinary intellectual property position", consisting of a portfolio that includes more than 100 patent filings. Nevertheless, an unspoken implication of this merger is that CNI saw that it should not go it alone as a carbon nanotube supplier. | |

| "The transaction was not the kind of exit a high profile company like CNI must have hoped for in its early days" says Serrato. He points out that CNI, as a market leader, was paid only approximately $5.4 million in Arrowhead common stock plus an undisclosed stake in the surviving Unidym entity. "This price indicates the relatively low value of a stand-alone carbon nanotube supplier. Even if CNI received a full 50% equity stake in the surviving Unidym entity, the decision reveals that the company's best option was to forego the dream of single-handedly benefiting from the broad growth of carbon nanotubes. Instead stockholders were forced to settle for sharing the value that a single customer, Unidym, could derive from using these carbon nanotubes in its intended target market." | |

| The merger also highlights that the ability to deliver applications and solutions, not just materials, will be essential to companies seeking successful exits in this space. | |

| Consolidation of the fragmented patent landscape is important to facilitating the development of the industry as a whole | |

| Carbon nanotube manufacturing is a perfect example where the commercial potential is vast, but the corresponding patent landscape is equally daunting (see our recent spotlight "Growing nanotechnology problems: navigating the patent labyrinth"). Firms seeking to manufacture nanotube-based products now face a dense thicket of patents and patent applications held by different universities, government labs, and companies. When products incorporating nanotubes begin to come to market in the near future, complicated and untested patent issues will confront lawyers and executives. | |

| Because of this, investments in companies developing related IP are harder to justify. Mergers could serve as a means to consolidate the patent landscape. "By consolidating many of the fundamental patents related to carbon nanotubes the merged company will be able to pursue a program to license packages of carbon nanotube patents outside of its core products" says Chen. "As such, the merger may encourage manufacturers to make new investments in carbon nanotube-based products, because they will have more direct access to multiple pieces of intellectual property needed to manufacture their product." | |

| A focus on electronics applications reveals where carbon nanotubes and other nanomaterials may have their greatest impact in the foreseeable future | |

| The Unidym/CNI merger demonstrates that the electronics industry may be the first to embrace carbon nanotubes. However, many companies in the industry do not have business strategies to realize this opportunity. | |

| "CNI was originally focused on enabling the most diverse applications possible and growing a range of markets for carbon nanotubes" says Chen. "Like many other nanotech companies, overshooting with inappropriately broad market focus reflected an early arrogance in the value of the underlying technology." | |

| The authors argue that nanotechnology companies stand to benefit from a more disciplined and realistic market approach that focuses on the most attractive markets. "CNI?s decision to combine with a carbon nanotube-based electronics company sheds light on where CNI management believed the most compelling opportunities for carbon nanotubes are in the near term." | |

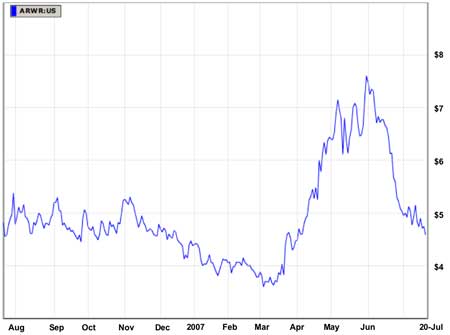

| The jury is still out as far as Arrowhead's stock price is concerned. Like most other nanotechnology stocks it hasn't participated in the broader market rally. After the huge spike following the merger announcement, the stock is back to where it was a year ago. | |

|

|

| Performance of Arrowhead's stock price over the past 12 months. Data source: Bloomberg. | |

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com.