| Oct 28, 2014 |

Climatescope 2014 - Global study shows clean energy activity surges in developing world

|

|

(Nanowerk News) Developing nations represent a large and rapidly growing share of the world’s clean energy investment, according to Climatescope 2014, a landmark study released today. The results suggest renewable technologies can be just as cost-competitive in emerging parts of the world as they are in richer nations.

|

|

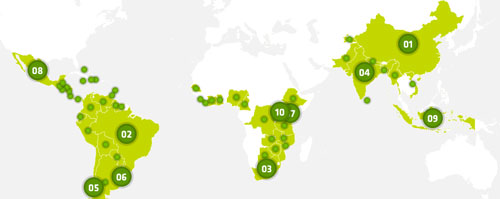

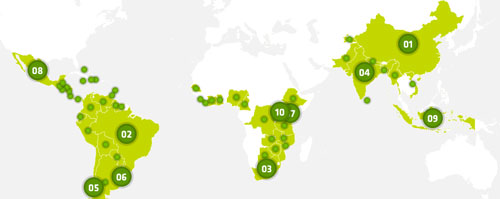

Climatescope, a country-by-country assessment, interactive report and index, offers the clearest picture yet of clean energy in 55 emerging markets in Africa, Asia and Latin America and the Caribbean. The findings show clean energy capacity added in these nations grew at a faster pace than in developed countries, more than doubling in the past five years and totalling 142 GW (more than France’s current capacity).

|

|

| THE TOP TEN: China, Brazil, South Africa, India, Chile, Uruguay, Kenya, Mexico, Indonesia, Uganda

|

|

Climatescope’s key findings include:

|

|

THE TOP TEN: China, Brazil, South Africa, India, Chile, Uruguay, Kenya, Mexico, Indonesia, Uganda

China ranks #1, but Brazil is close behind at #2: China received the highest ranking as the largest manufacturer of wind and solar equipment in the world and the largest demand market for said equipment.

South Africa, Kenya and Uganda were among the top scorers: All have significant clean energy projects and programs; South Africa has surged ahead with nearly $10bn of clean energy investment undertaken in the last two years.

Latin American and Caribbean nations were buoyed by Brazil, but also relative newcomer Uruguay: While Brazil still dominates, Latin America and the Caribbean as a whole is emerging as a destination for clean energy investment.

Small-scale renewables offer the most efficient way to provide energy access to vast numbers of people living without power. Tanzania has the most advanced regulation to encourage these types of projects, with a host of small power projects in the pipeline.

Demand for clean energy is growing faster on a percentage basis in these countries than in more developed nations. From 2008-2013, Climatescope nations added 142 GW (a bit more than the current total installed capacity of France) of new, non-large hydro renewables capacity. That represented a 143% growth rate. By comparison, wealthier OECD nations added 213GW, posting a clean energy capacity growth rate of 84%.

Climatescope shows that countries are rapidly strengthening their policy frameworks: Stronger policies attract more clean energy investment.

|

|

The Multilateral Investment Fund (MIF) of the Inter-American Development Bank Group (IDB), the UK Government Department for International Development (DFID), and the US Agency for International Development (USAID), under President Barack Obama’s “Power Africa” initiative, commissioned Bloomberg New Energy Finance (BNEF) to analyze and rank development prospects for solar, wind, small hydro, geothermal, biomass, and other zero-carbon emitting technologies (excluding large hydro). This report provides potential investors with important information identifying countries with the greatest

clean energy investment opportunities.

|

|

Climatescope was developed in 2012 by the MIF/IDB and BNEF, and initially evaluated 26 countries in Latin America and the Caribbean. This year’s expanded project includes 19 countries in Africa, 10 in Asia, as well as 15 provinces in China and 10 states in India thanks to additional support from DFID and USAID.

|

|

“The Inter-American Development Bank is pleased to see DFID and USAID join the Climatescope project to identify key drivers and markets for clean energy investment globally,” says Luis Alberto Moreno, President of the Inter-American Development Bank. “This marks the third year of the Climatescope project, which aims not only to be a snapshot of where clean energy policy and finance stand today, but more importantly, serves as a guide to where clean energy opportunities can lie tomorrow.”

|

|

A country’s ranking depends upon various factors: its clean energy investment policy, its market conditions, the structure of its power sector; the number and makeup of local companies operating in clean energy; and efforts toward reduction of greenhouse gas emissions. The final output is the most comprehensive, one-stop source for decision makers to learn more about the market conditions for clean energy in these regions.

|

|

“Private sector investment is vital if developing countries are to improve their renewable energy provision and underpin economic growth,” said the Rt Hon Justine Greening. “Climatescope boosts the investment potential of this market by giving investors the information they need to make reliable funding decisions, thereby helping millions of people to access modern forms of energy and improve their quality of life. The UK’s support has enabled Climatescope to expand benefitting countries in Africa and Asia.”

|

|

|

|

All of the research is easily accessed at www.global-climatescope.org, which includes an interactive tool for users to pinpoint specific information, from the most granular country details to specific sector analysis. The website also allows for complete downloads of the Climatescope data in Excel format.

|

|

“Climatescope is a critical resource for the Power Africa initiative and our partners, providing an in-depth and objective evaluation of low-carbon energy opportunities in emerging markets, including Africa,” said U.S. Agency for International Development Administrator Dr. Rajiv Shah. “With over $20 billion in project financing commitments from our private sector partners, Power Africa aims to add 30,000 megawatts of cleaner, more efficient electricity generation capacity throughout sub-Saharan Africa.

|

|

Climatescope’s evaluation of the rapid growth of supply and demand for clean energy in Africa reinforces an important reality; Power Africa’s goal to expand energy access across the continent can and should be met in large part through clean energy development, whether at the utility scale or beyond the grid.”

|