| Posted: Nov 14, 2007 | |

Nanotechnology investing - understanding the technology and accepting the time frames are key |

|

| (Nanowerk Spotlight) Slowly but surely the realization begins to sink in that there is no quick buck to be made for individual investors in nanotechnology companies (except for the people pushing investment advice of course). Existing public nanotechnology firms as a group have performed sub-standard (to put it politely); there isn't exactly a flood of nanotech IPOs on the horizon; and many product advances that have to do with nanotechnologies are made by large companies which either make these advances silently (witness the cosmetics industry) or tout them as major breakthroughs (like IBM's 'airgap' technology). | |

| In any case, all these nanotechnology-based materials are incremental improvements over existing materials - leading to better coatings, more efficient batteries and fuel cells, better performing materials, etc. - and not revolutionary devices. Of course, when we look back 10 years from now, there will have been one or two great performing nanotech stocks; but then there will be one or two great performing stocks in almost any other investment sector. | |

| Nevertheless, there are many start-ups and early stage companies out there - some might even make it to the IPO (initial public offering) stage or be bought by larger companies - and given the nature of the field, with its broad and multidisciplinary character, it certainly is helpful for the professional investor to be able to gauge the nanotechnology investment landscape from a technology perspective. | |

| A recent article describes a methodology to categorize different nanotechnologies into one of three types: passive, active, or hybrid nanotechnologies, each with different time horizons for expected commercial viability. | |

| Just a brief recap on the performance of the nanotechnology indices. The three major exchange-quoted indexes are the ISE-CCM Nanotechnology Index (launched in late 2005; symbol $TNY), the Lux Nanotechnology Index (launched in late 2005; symbol $LUXNI), and the Merrill Lynch Nanotech Index (launched in early 2005; symbol $NNZ). We took November 2005 as the starting point (that's when TNY and LUXNI were launched) and mapped against the Dow Jones Industrial Index. This is now the third time in the past 12 months that we are drawing this chart (the first time was in January: Investing in nanotechnology stocks - golden opportunity or bad idea?) and the second time in July: The struggle of nanotechnology companies to create value) and it's not getting prettier. | |

|

|

| Performance of nanotechnology stock indices. Source: Nanowerk analysis; data from Bloomberg; orange line: Dow Jones Industrial Average. Last data point is November 9, 2007. | |

| Probably not much help for an individual investor, who depends on publicly traded stocks for his investment, but an interesting guidance for professional investors in early stage companies, Dr. James M. Tour has published an article in the Fall 2007 issue of Nanotechnology Law & Business ("Nanotechnology: The Passive, Active and Hybrid Sides—Gauging the Investment Landscape from the Technology Perspective") where he describes a tool to pigeonhole a specific nanotechnology in order to gauge its commercialization horizon (0–5 years vs. 15–50 years vs. 7–12 years) based on the nanotechnology type: a passive, active or hybrid nanotechnology, respectively. | |

| Tour is the Chao Professor of Chemistry, Professor of Computer Science, and Professor of Mechanical Engineering and Materials Science at Rice University and is also Director of Rice University’s Carbon Nanotechnology Laboratory in the Smalley Institute for Nanoscale Science and Technology. | |

| Tour's basic premise is that investors are (or at least should be) proficient in assessing the business aspects of prospective investments in technology companies. Often though, especially with nascent and emerging fields like nanotechnologies, the technology horizon assessment remains illusive. By grouping different nanotechnologies into "passive", "active" and "hybrid" nanotechnologies he sets out to define categories that might be helpful to get a better grip on assessing a technology's time horizon with regard to commercialization. Some of his comments might also somewhat deflate the balloons of proponents of revolutionary, molecular manufacturing type nanotechnology. While he doesn't say it won't happen, he adds several decades to the more optimistic forecasts that are out there. | |

| "The truly exciting developments in nanotechnology, the ones that are science fiction-like in vision, are often 30-50 years away, or even 100 years out, so my suggestion is to invest elsewhere unless you have a dynasty-like horizon and the capital to sustain the vision at each round throughout the century" Tour tells Nanowerk. "Our research in the area of passive nanotechnology has shown that the simple addition of a nanomaterial to a host matrix can have a profound effect on the behavior of the overall composite structure, and applications are foreseeable in the near-term. The active nanotechnological components, which require far greater control, afford exciting laboratory demonstrations but their utility is generally far off. The hybrid systems, that enhance known complex platforms, are intermediate in horizon." | |

| In his article, Tour defines his three categories based on the role of nanotechnology in manufacturing a material or fabricating a device – is it active or passive? Of course, there are always instances where you want to have it both ways – hybrids. To quote from the article: | |

| Passive nanotechnology: The nano part does nothing particularly elaborate. Its presence alone adds a significant increase to the performance of the system. As an example, I will describe how the addition of functionalized carbon nanotubes to rubber can greatly enhance the toughness of rubber without a loss in the strain-at-break (the distance that it can be stretched before unrecoverable failure). The applications of these passive systems are being realized today in commercial products, and the time from lab to market is generally in the 0–5 year time frame. | |

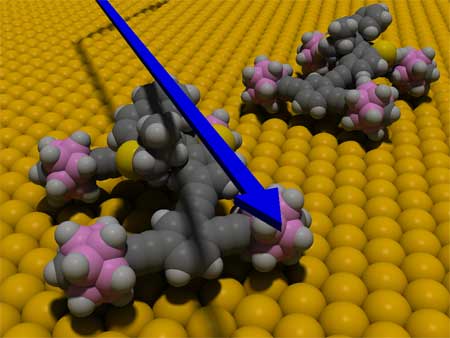

| Active nanotechnology: In this case the nano entity does something elaborate such as absorbing a photon and releasing an electron, thereby driving a device, or moving in a specific and definable fashion across a surface. I will use the example of nanocars. The applications of these active systems in commercial products are generally in the 15-50 year time frame, sometimes even beyond that. Many nano-health related applications fall into this category due in large part to the obligatory FDA approval processes for manufacture and safety, which might also end up with an added level of “nano-safety” scrutiny. No doubt, the active nanotechnologies are visionary and exciting, but my advice is to leave your checkbook at home and let your tax-dollars work through federal government grants. The risk in a small company seems to increase exponentially with time. People get diverted, tired and over decades they tend to die. These long-horizon targets are, at best, only part of the “sophisticated” VC’s mega-fund where they can use it as the raffle ticket at the pinnacle of their showcase. | |

|

|

| An example for active nanotechnology from work in Tour's lab, this image depicts two motorized nanocars on a gold surface. The nanocar consists of a rigid chassis and four alkyne axles that spin freely and swivel independently of one another. The wheels are spherical molecules of carbon, hydrogen and boron. (Image: Yasuhiro Shirai/Rice University) | |

| Hybrid nanotechnology: The complementing of a known platform through the attachment of a nano-sized entity but where the platform carries the bulk of the burden. An example would be using a silicon platform to carry out electronics, but making the silicon work with higher performance through the attachment of a surface layer of organic molecules that donate or accept charge. I concede that the definition here could be somewhat difficult to separate from passive or active systems, and some might want to only have the two former areas of definition. I would not argue otherwise, but in some cases this third category can add further clarity: a hybrid, of sorts, between the passive and active sides. As suspected, the commercial realization of hybrid systems would often reside between the passive and hybrid development periods, namely in the 7–12 year time frame. | |

| Tour goes on to describe these three categories in more detail and provide examples for each from the work in his own lab. You can find a more technical description of these areas, as well as Tour's transition from small molecule organic synthesis into polymeric materials and nanotechnology – which led to receipt of the Arthur C. Cope Scholar Award in 2007 – in a recent paper in Journal of Organic Chemistry ("Transition to Organic Materials Science. Passive, Active, and Hybrid Nanotechnologies"). | |

| Tour learned his business lessons the hard way: "I saw one nanotechnology start-up dashed on the rocks because it was an active nanotechnology, and none of us had the muscle or money to see it through the many decades required for success" he says. "In other cases, the passive systems in particular have been far less painful." | |

| Playing it a bit safer now, Tour and some of his group members offer their insights and expertise to potential nanotechnology investors, helping them to assess the technological aspects of their prospective investments. | |

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

|

|

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com. |

|