| Posted: Dec 16, 2014 | |

How the insurance market perceives nanotechnology risks |

|

| (Nanowerk Spotlight) Insurance companies are major stakeholders capable of contributing to the safer and more sustainable development of nanotechnologies and nanomaterials. This is owed to the fact that the insurance industry is one of the bearers of potential losses that can arise from the production and use of nanomaterials and nanotechnology applications. | |

| Researchers at the University of Limerick in Ireland have examined how the insurance market perception of nanotechnology can influence the sustainability of technological advances and insurers’ concern for nanotechnology risks. They claim that, despite its role in sustaining technology development in modern society, insurers' perception on nanomaterials has been largely overlooked by researchers and regulators alike. | |

| Their paper ("Insurance Market Perception of Nanotechnology and Nanomaterials Risks") in the Risk Management newsletter of The Geneva Association seeks to address this gap by providing some insight into the insurers' awareness and perception on nanotechnology and nanomaterials risks. | |

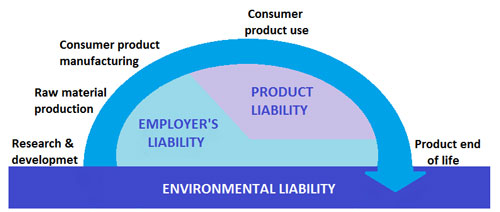

| Insurance losses can arise at any stage of nanomaterial production and use. The figure below shows how different insurance policies relate to the life cycle of products containing nanomaterials: | |

|

|

| The life cycle of products containing nanomaterials and the type of insurance products that can be impacted. | |

| Workers can become exposed to nanoparticles and nanomaterials during different stages of the product life cycle such as research and development, raw material production, consumer product manufacturing as well as at the end of the product’s life. The employer’s liability insurance policies can be triggered if some nanomaterials happen to be hazardous to the workers’ health. | |

| Consumers and the public can come into contact with nanomaterials once the product has reached retailers' shelves. The probability of exposure increases if the consumer does not follow the instructions and/or directions for product use and handling, or if the product is damaged. All sellers or providers of services and repair (e.g. manufacturers, wholesalers or retailers of products containing nano-applications) may incur liability to their customers and others for injury, illness, loss or damage arising from the supply of goods. Liability may arise under common law, under contract or under statute. | |

| In addition to employer liability and product liability losses, there can be losses arising out of environmental liability. There are numerous scenarios in which the environment can become contaminated at any stage of the nanotechnology life cycle. These include industrial accidents at the production and manufacturing stage, spillages, leakages and toxic waste accumulation in landfills. | |

| Products containing nanomaterials are becoming increasingly more available in areas like medicine, automotive, food, electronics and appliances. This means that professionals such as medical doctors and corporate directors and officers can become subject to some nanotechnology risks (e.g. professional liability can arise from wrong dosages or drug prescription). | |

| The University of Limerick researchers, Lijana Baublyte, Martin Mullins, Finbarr Murphy and Syed A.M. Tofail, set out to assess the perceptions of the insurance market on the development and use of nanotechnology and nanomaterials. They employed two primary data collection methods. The first phase of research involved interviewing experts in the insurance and nanoscience fields. Informed by this information, they then designed a questionnaire regarding the perceived benefits and risks of nanotechnology. Study participants were asked to express their judgements on the perceived risks of different nanomaterials applications, as well as whether they believed nanomaterials posed potential hazards for workers, consumers, public and animal health and environmental pollution. | |

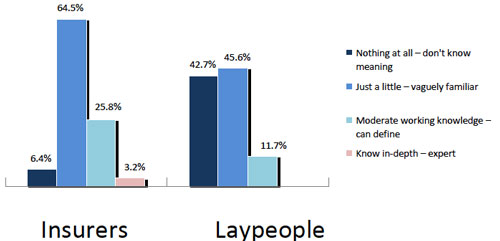

| According to the authors, qualitative and quantitative data analysis results show that insurers are relatively aware of nanotechnology and nanomaterials. Over 64 per cent of surveyed insurers said they were vaguely familiar with nanotechnology and nanomaterial terms, and over 25 per cent said they had a moderate working knowledge and were able to define the terms. The interview data, however, suggests that this knowledge is at a basic level and there is a need for more information in order to allow this group to differentiate between distinct nanomaterial risks. | |

|

|

| Insurers (N=31) and lay people (N=103) awareness of nanotechnology and nanomaterials risks. | |

| The survey results reveal that insurers are mostly worried about the environmental pollution in the five areas covered by the survey. Over 35 per cent of insurance professionals indicated that they believed nanomaterials to pose a high risk to the environment and 45.2 per cent believed that it was a minor risk. Only 6.5 per cent of insurers said they thought that the production and use of nanomaterials would not contribute to environmental pollution. In comparison, the experts group was marginally more concerned about the risk to the environment, with nearly 39 per cent of the scientists believing that nanomaterials could pose a high risk to the environment and only 2.6 per cent said that they considered this technology to be risk free. | |

| The experts group was also significantly more worried about workers' health than the insurers group was. Nearly 60 per cent of the surveyed nanoscientists said that they believed nanomaterials posed a high risk to workers' health, whereas only 32.3 per cent of the insurers surveyed thought them to be high risk. | |

| Overall, insurers were relatively more worried about consumers and public and animal health as compared to the experts group's perceptions, which mainly considered the exposure to nanomaterials in these areas to pose minor risks. The lay people group was significantly less concerned about the exposure to nanomaterials in relation to the environment, workers, consumers and public health in comparison to the surveyed insurers group. | |

| The authors conclude that their qualitative and quantitative data indicate that insurers are familiar with the nanotechnology and nanomaterials terms. Moreover, although, insurers are more aware of the technology than the lay people, this familiarity is still at a basic level. | |

| Given the fact that the insurance industry is one of the main bearers of the potential nanotechnology and nanomaterials risks, this suggests a need for more information transfer and exchange between the different stakeholders such as nanoscientists, regulators, nanotech companies and insurers themselves. | |

| The researchers also suggest that better risk communication and collaboration between the insurance market, nanoscientists, regulators as well as nanotechnology companies could lead to the introduction of new insurance products. This, in turn, would directly contribute to the sustainability of nanotechnology and nanomaterials development and use. | |

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

By

Michael

Berger

– Michael is author of three books by the Royal Society of Chemistry:

Nano-Society: Pushing the Boundaries of Technology,

Nanotechnology: The Future is Tiny, and

Nanoengineering: The Skills and Tools Making Technology Invisible

Copyright ©

Nanowerk LLC

|

|

|

Become a Spotlight guest author! Join our large and growing group of guest contributors. Have you just published a scientific paper or have other exciting developments to share with the nanotechnology community? Here is how to publish on nanowerk.com. |

|